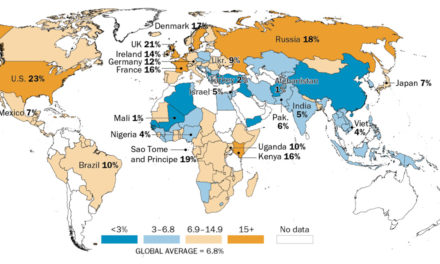

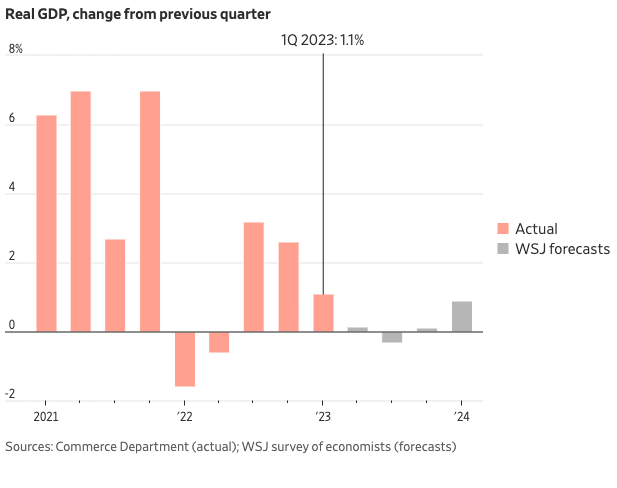

Economic growth slowed in the first quarter of 2023, leading some experts to conclude that an economic recession is now in sight.

Real gross domestic product (GDP) increased at an annual rate of 1.1 percent during the first quarter (Q1) of the year, according to the Bureau of Economic Analysis’ most recent “advance” estimate.

The GDP is the value of all goods and services produced by an economy. The most common definition of a recession is two straight quarters of negative GDP growth, i.e., an economy that is contracting rather than expanding.

In Q4 of 2022, real GDP had increased 2.6 percent on an annual basis.

The Q1 GDP number fell far below the 2.5% growth that most economics had expected.

Photo Credit: Wall Street Journal

Speaking to the Daily Citizen, EJ Antoni, who serves as the Research Fellow for Regional Economics in the Center for Data Analysis at The Heritage Foundation, said this morning’s numbers provide further evidence that the U.S. economy is headed towards a recession.

“We’re seeing growth slow as inflation accelerates,” Antoni said. “Obviously, that’s a really bad recipe. Frankly, that’s a recipe for stagflation. It’s another indicator that we’re on the wrong track.”

Stagflation is an economic phenomenon characterized by slow economic growth, high inflation and high unemployment. In other words, it’s no fun – and it’s difficult to solve, as policies to solve high unemployment generally worsen inflation, and vice versa.

Antoni also gave advice for families, who are trying to figure out how to weather economic headwinds.

“Families don’t need these reports to know what’s going on. Families are faced with the high cost-of-living day in and day out. They already know they’ve become substantially poorer over the past two years,” Antoni said. He added:

Families should do exactly the opposite of what they do in Washington, D.C. You want to spend less than you earn. You want to make sure you have a rainy-day fund. And in recessions, unemployment rises, so people need to be prepared for that.

Within the family context, financial difficulties can lead to conflicts, which are important to address and resolve.

One 2018 survey found a convincing link between relationship difficulties and finances. This survey found that “money fights are the second leading cause of divorce, behind infidelity” (emphasis added).

“Both high levels of debt and a lack of communication are major causes for the stress and anxiety surrounding household finances,” the survey found.

In a statement to the Daily Citizen, Geremy Keeton, Licensed Marriage & Family Therapist and Senior Director of Focus on the Family’s Counseling Services Department, suggested families face their struggles – especially financial ones – head on.

“In challenging or even dour times, families can show what they are made of – they can still grow, and often for the good, through trials,” Keeton said.

He added:

Despite what is happening at a macro-level nationally, we have to take responsibility on the home front and balance our own budgets to the realities that exist. Individuals need to be realistic and sometimes even creative with how they save or generate supplemental income. Adjustments to such hard times work best with optimism, flexibility and even extra thankfulness for what we do have.

However, Keeton also encourages a positive, fuller-picture approach,

We don’t have to be defined by a “sky is falling” approach to life – wealth and wellbeing in a marriage or family system is actually rooted in so much more “than the numbers.” It’s in the healthy emotional process of a family system – in how they connect to one another as a team solving a problem and connecting to their faith.

If you’re struggling and need to speak with someone, Focus on the Family offers a free, one-time counseling consultation with a licensed or pastoral counselor. To request a counseling consultation, you can call 1-855-771-HELP (4357) or fill out our Counseling Consultation Request Form.

In addition, you can purchase a copy of Dave Ramsey’s bestseller The Total Money Makeover: A Proven Plan for Financial Fitness from the Focus on the Family bookstore here.

Related articles and resources:

Counseling Consultation & Referrals

New Family Affordability Survey Finds ‘Catastrophic Erosion’ of Middle-Class Life in America

Managing Your Money During Uncertain Times

Being Wise With Your Money During a Crisis

Getting on the Same Page Financially in Marriage