As part of the CARES Act stimulus bill passed by Congress and signed into law by President Trump on March 27, $367 billion was set aside for the Small Business Administration (SBA) to help small businesses that are hurting from the effects of loss of business and/or shutdowns ordered by government entities.

One of the programs the SBA will administer is called the Paycheck Protection Program (PPP), which guarantees small business loans to employers with less than 500 employees. The PPP loans can be used to keep employees on the payroll, pay for health insurance, mortgages, utilities and the like if the charity has been impacted by the effects of government stay-at-home and closure orders. The loans will be forgiven if they are used for such purposes.

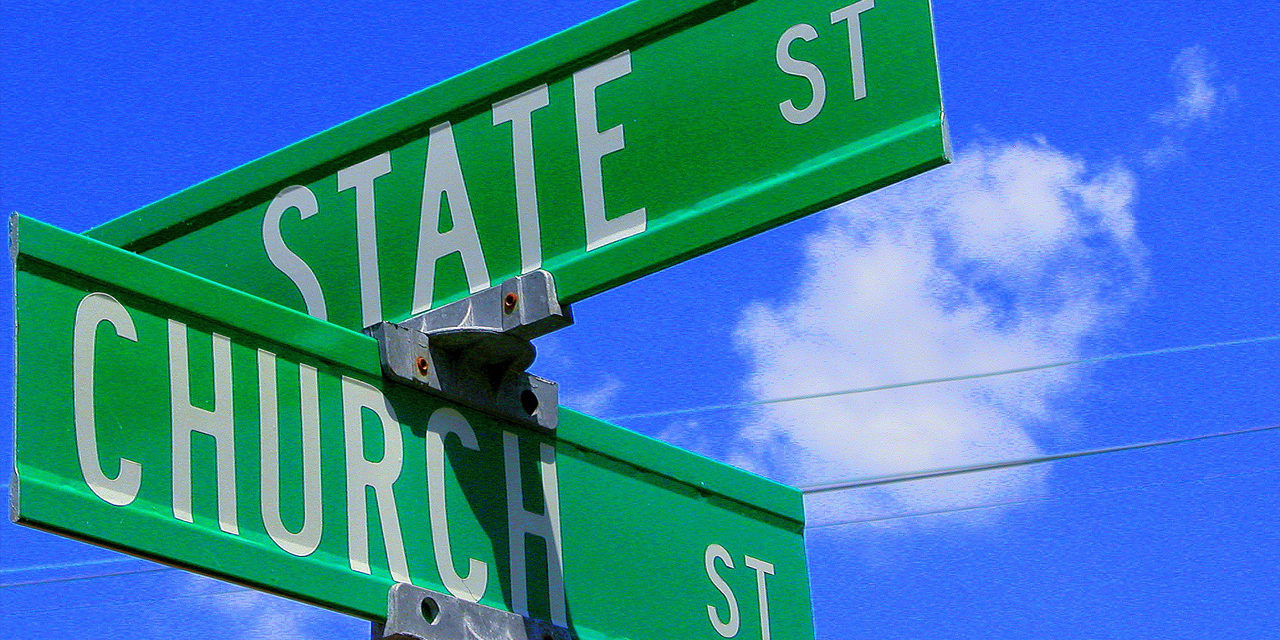

Secular groups immediately – on March 31 – pushed the typical “separation of church and state” argument in a letter to the head of the SBA, Jovita Carranza, demanding that no loans go to religious entities. The SBA already had rules in place, the secular groups argued, that prohibited any SBA benefits from going to “businesses principally engaged in teaching, instructing, counseling or indoctrinating religion or religious beliefs, whether in a religious or secular setting.”

The atheists also argued that SBA nondiscrimination rules should be enforced against religious entities. That means, for example, that if a church believed in traditional marriage and that “sex” refers to biological characteristics at birth, that church would be potentially ineligible for an SBA loan.

After a bipartisan group of members of Congress sent their own letter to Carranza explaining that the CARES Act did not limit benefits only to secular businesses, the SBA issued an Interim Final Rule on April 2 making clear that religious entities were eligible for loans, and they would not be discriminated against because of their religious beliefs.

Why should churches and other faith-based organizations be included in the PPP? Aren’t we talking about closed restaurants, shops and other secular businesses?

The answer is because churches are equal participants in furthering the government’s goals of protecting communities.

First, they complied with the government’s orders just as secular businesses have done, and they’ve suffered the same consequences. When churchgoers are not attending in person, donations drop, and the church cannot keep up with expenses.

Second, church members pay taxes which are used in part to fund the stimulus bill. It’s fair that some of that money should go to their churches.

Joe Carter, author, editor, and executive pastor at McLean Bible Church in Virginia, argues that churches and government participate in a “shared social responsibility” and thus churches should seek out these loans if needed.

“According to the IRS, the rationale for granting tax exemption to certain private entities—such as churches—is based on the theory of shared social responsibility,” Carter says. “The position of the IRS is that the government and its citizens jointly share the responsibility for the well-being of the entire nation.

“The current COVID-19 crisis provides a prime example of this concept in action. Most churches in the United States have been willing to share the social responsibility of protecting the public health by shutting down their operations, including Sunday services. This willingness to comply with government directives has taken a significant financial toll on many churches. Like many other Americans, I believe it would be a violation of the ‘theory of shared social responsibility’ for the government to ask churches (and church members) to do their part and yet say ‘You’re on your own’ when it comes to shouldering the financial burden,” Carter concludes.

Will churches and other faith-based organizations risk entanglement with the government by participating in this program? Shouldn’t they steer clear of accepting money from the federal coffers in order to retain their independence?

First, the loans don’t come from the government. They come from the church’s normal bank, but they are backed by the SBA and the SBA will pay the bank, not the church.

The choice to apply for, and receive, these loans is something where reasonable Christians can disagree, according to Dr. Russell Moore, head of the Ethics and Religious Liberty Commission of the Southern Baptist Convention. Furthermore, he notes in an op-ed that the church’s bank account is already guaranteed by a federal agency, the Federal Deposit Insurance Corporation (FDIC).

Churches are not singled out for special treatment under this law. They are covered by the same benefits and rules as any secular entity. Furthermore, the U.S. Supreme Court ruled in Trinity Lutheran Church v. Comer in 2017 that government programs that are generally offered to the public cannot exclude faith-based entities because merely of their religious beliefs.

The bottom line here is that the Paycheck Protection Program includes churches and faith-based entities, as it ought to; it doesn’t violate the First Amendment by entangling church and state; and it’s up to each church or faith-based entity to decide whether to apply for a loan or not.

Churches are providing some of the greatest benefits our country needs right now, including a source of hope in the One who knows all our needs. I’m grateful to see that they are receiving some help in return.