Inflation rose 0.1 percent in the month of March, the U.S. Bureau of Labor Statistics (BLS) reported on Wednesday morning. Over the past year alone, prices have risen 5%.

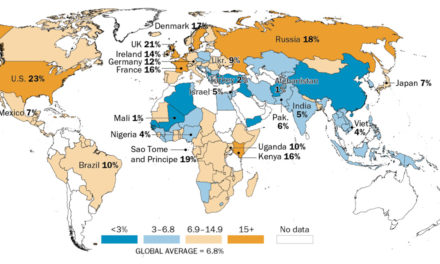

Over the past year, prices for the following categories have risen by the following amounts:

- Food has risen 8.5%.

- Energy services have increased 9.2%.

- Electricity has increased 10.2%.

- New vehicles have risen 6.1%.

- Shelter has increased 8.2%.

- Transportation services rose 13.9%.

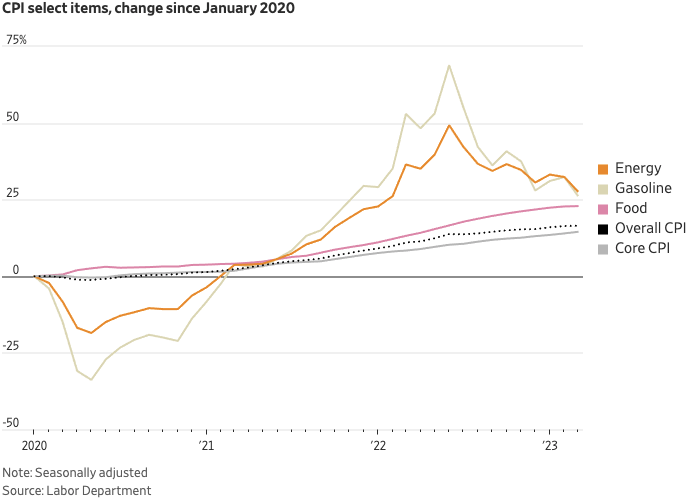

However, today’s prices are shockingly higher when compared to those just prior to the COVID-19 pandemic. Since January 2020, prices have risen by the following amounts:

- Prices overall have increased by 16.5%.

- Food has increased 22.9%.

- Gasoline has risen 26.4%.

- Energy has shot up 27.8%.

Photo Credit: The Wall Street Journal

Many workers have received substantial raises over the past several years. However, all these raises have been eaten away due to inflation.

As EJ Antoni, the Research Fellow for Regional Economics in the Center for Data Analysis at The Heritage Foundation, points out, “Average hourly earnings have risen 11% since Jan ’21 but real earnings are down 4% because prices have risen 15% over the same time.”

Average hourly earnings have risen 11% since Jan '21 but real earnings are down 4% because prices have risen 15% over same time: pic.twitter.com/YUJUgAMAaV

— EJ Antoni (@RealEJAntoni) April 12, 2023

Antoni notes that “real weekly earnings loss combined with higher borrowing costs from interest rate hikes has effectively reduced [the] average family’s annual income by $7,100” (emphasis added).

In other words, families are struggling. And if you feel like you can barely keep your head above water financially, despite receiving raises over the past several years, you’re not imagining things.

According to CNBC, a large majority of Americans – 72% – say their earnings are falling behind the cost of living. In addition, 74% say they are currently unable to save for their future.

These sentiments are backed up by reality.

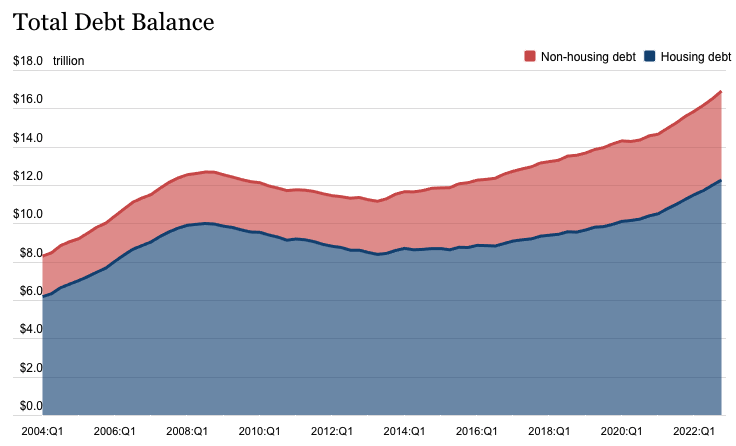

As of the last quarter of 2022, Americans held a record level of credit card debt at $986 billion.

And yet, credit card debt is just one type of debt. Americans also owe $340 billion in home equity lines of credit, $1.6 trillion in student loan debt, $1.55 trillion in auto loans, $510 billion in other debt plus a staggering $11.92 trillion in mortgage debt.

The total amount?

$16.90 trillion in debt, which is $2.75 trillion higher than at the end of 2019 before the pandemic.

Photo Credit: New York Fed

It’s no wonder that a majority of Americans – 57% – say they would be unable to afford a $1,000 emergency expense.

It’s important to realize that these economic difficulties don’t stay in the economic realm. Financial hardships aren’t just realized on a spreadsheet or checkbook, they bleed into our relational and spiritual lives as well.

One 2018 survey found a convincing link between relationship difficulties and finances. This survey found that “money fights are the second leading cause of divorce, behind infidelity” (emphasis added).

“Both high levels of debt and a lack of communication are major causes for the stress and anxiety surrounding household finances,” the survey found. Here are a few other findings from the survey:

- Nearly two-thirds of all marriages start off in debt.

- One-third of people who say they argued with their spouse about money say they hid a purchase from their spouse.

- Ninety-four percent of respondents who say they have a “great” marriage discuss their money dreams with their spouse.

- Sixty-three percent of those with $50,000 or more in debt feel anxious about talking about their personal finances.

Craig Constantinos, MA, LPCC in the Counseling Services Department at Focus on the Family, spoke to the Daily Citizen about our economic climate and how families can deal with these struggles.

“Stress and anxiety about the economy can often lead to frustration and conflict in marriages, as finances is one of the areas where different perspectives are most obvious,” Constantinos said.

“Having a grace-filled conversation about budgets and spiritual and financial goals can lead to deeper understanding in a marriage, which can turn the challenge of financial uncertainty into an opportunity to build one’s relationship with God and their spouse.”

If you’re struggling and need to speak with someone, Focus on the Family offers a free, one-time counseling consultation with a licensed or pastoral counselor. To request a counseling consultation, you can call 1-855-771-HELP (4357) or fill out our Counseling Consultation Request Form.

In addition, you can purchase a copy of Dave Ramsey’s bestseller The Total Money Makeover: A Proven Plan for Financial Fitness from the Focus on the Family bookstore here.

Related articles and resources:

Counseling Consultation & Referrals

New Family Affordability Survey Finds ‘Catastrophic Erosion’ of Middle-Class Life in America

God-Honoring Money Habits for Kids

Equipping Your Kids to Handle Money

Getting a Reluctant Spouse Onboard with Budgeting

Money Talk: The ‘You’ in ‘Unity’ is Silent

Photo from Shutterstock.