Have you noticed that you’re paying more at the pump? Filling up your tank is much more painful now that it was a year ago. Or maybe you’re shopping around for a used car and are surprised that prices seem to be higher than you remember.

Well, you’re not imagining things.

The U.S. Bureau of Labor Statistics (BLS) announced on Wednesday that the Consumer Price Index (CPI) increased by 0.5% in July but has increased 5.4% year-over-year from July 2020 to July 2021.

That means Americans are paying on average 5.4% more in categories like food, shelter, energy and clothing than they were just one year ago.

“The indexes for shelter, food, energy, and new vehicles all increased in July and contributed to the monthly all items seasonally adjusted increase,” BLS announced.

It added that prices have increased year-over-year in the following categories:

-

- Food increased 3.4%.

- Energy was up a massive 23.8%.

- Gasoline rose an astounding 41.8%.

- Used cars were 41.7% higher.

- New vehicles increased 6.4%.

This means that even though the economy has recovered significantly from the COVID-19 recession, families are likely feeling a pinch in their pocketbooks, and shelling out more than they planned for everyday items.

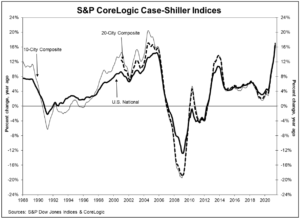

One area that is hitting families the hardest is the massive increase in the price of homes.

Home prices are jumping to record highs, at rates not seen in 30 years.

According to the S&P CoreLogic Case-Shiller Indices, in May 2021, the average price of a home increased by 16.6% from just one year prior.

Some cities saw even higher price increases. “Phoenix, San Diego, and Seattle reported the highest year-over-year gains … Phoenix led the way with a 25.9% year-over-year price increase, followed by San Diego with a 24.7% increase and Seattle with a 23.4% increase.”

To put this in actual numbers, the St. Louis Fed reports that the median sale price of houses sold in the U.S. increased from $322,600 in the second quarter of 2020 to $374,900 in the same quarter of 2021. That’s an increase of $52,300 in just one year, or 16.2%.

Photo from: S&P Dow Jones Indices

This is great news for those looking to sell their house, but is extremely harmful for young families, and millennials who may be looking to buy their first home. Many have now been priced out of the market and may be forced to rent, which is also becoming more expensive.

Frank Martell, president and CEO of CoreLogic, warned that “first-time buyers are hitting a wall in many places around the country.”

“Younger and first-time buyers, including younger millennials, are faced with the challenge of having sufficient savings for a down payment, closing costs and cash reserves,” he added.

All of these drastic increases in prices can be summed up in one word: inflation.

Inflation is the reduction in the value of a currency, and an increase in the prices of goods and services.

Now, the federal government aims to ensure that inflation runs around 2% each year. If that held true, over 10 years, inflation would total 20%.

For example, let’s say you decided to save $50,000 in 2011. What has happened to that money since then? Now, if you were to spend it, you would need $60,000 to purchase what you could have bought with $50,000 ten years ago.

Where did that money go? It disappeared, slowly and silently through the devaluing power of inflation.

Of course, this example doesn’t even consider what would happen if inflation reached more than 2%, which it now has.

One of the most pernicious effects of inflation is that it rewards bad financial behavior, like borrowing and spending, and punishes good decisions like saving.

Americans are encouraged to buy what they want now, since their money won’t be worth as much tomorrow. Likewise, Americans are disincentivized to save for the same reason.

Proverbs 22:7 reminds that that “the borrower is the slave of the lender” (ESV). And yet, inflation encourages us to become a nation of debtors, and therefore, slaves.

Much of the problem lies with Federal Reserve Chairman Jerome Powell, who recently admitted responsibility for inflation. Last year, the Fed created trillions of dollars out of thin air, and lowered interest rates to almost 0%, contributing substantially to the inflation we see today. And Congress’ decision to spend trillions more added gas to the fire.

“My best estimate is that this is something that will pass,” Powell said at a virtual press conference. “But we’re actually responsible for this, though, so we have to take seriously the risk case, which is that inflation will be more persistent.”

But something Powell didn’t acknowledge is that even though the spike in inflation may be temporary, its effects will last.

Let’s say inflation spikes 5% in one year, but then drops to 0% for the next year. Even though the 5% increase was temporary, families will still be paying 5% higher prices in perpetuity, month after month, year after year. Unless deflation occurs, families will be stuck paying that 5% increase forever. That’s not “something that will pass.”

And here lies the rub. Inflation harms families by increasing the cost of living. It hurts younger people who are trying to start families of their own by driving up the cost of become a first-time home buyer. And it costs those who have been wise to save their money while rewarding the profligate.

A nation attuned to the Good Book would realize the terrible consequences of unchecked, out-of-control spending.

Because as the saying goes, there’s no such thing as a free lunch.

Related articles:

Inflation Spikes 5.4% in June, Largest Increase Since 2008

Photo from Shutterstock