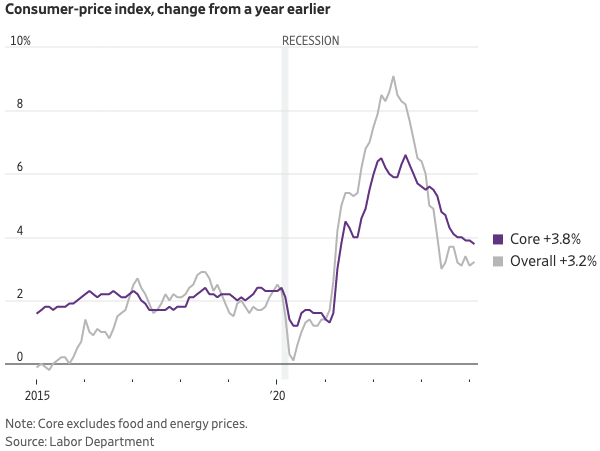

The inflation rate accelerated last month, increasing 0.4% in February after rising 0.3% in January, the U.S. Bureau of Labor Statistic (BLS) reported on Tuesday. The BLS reported that over the last 12 months, the U.S. Consumer Price Index (CPI) increased 3.2%.

The CPI is one measure of inflation; it tracks the average change in the prices paid by consumers for goods and services over the course of one year.

“The index for shelter rose in February, as did the index for gasoline. Combined, these two indexes contributed over sixty percent of the monthly increase in the index for all items,” the BLS reported.

Over the past 12 months, the following good and services have become more expensive:

- Food away from home has increased 4.5%.

- Electricity has risen 3.6%.

- Shelter has increased by 5.7%.

- Transportation services have risen 9.9%.

The CPI has come down substantially from its peak inflation rate of 9.1% in 2022. However, the 3.2% CPI is still substantially larger than the Federal Reserve’s “target rate” of 2.0%.

The Fed is the United States’ central bank tasked with controlling interest rates and the money supply to maintain stable prices and achieve maximum employment in the U.S. economy.

Because the inflation rate compounds annually, inflation is up by more than 19% since before the COVID-19 pandemic in 2020. That means $100 in January 2020 has the same buying power as $120.29 today, according to the BLS’ CPI Inflation Calculator.

“Today, a family of four is paying $15,133 per year, or $1,261 per month, more to purchase the same goods and services” compared to January 2021, the House Budget Committee explains.

In a statement to the Daily Citizen, Geremy Keeton, Licensed Marriage and Family Therapist and Senior Director of Counseling at Focus on the Family, told us that families should face tough financial struggles head on.

“In challenging or even dour times, families can show what they are made of – they can still grow, and often for the good, through trials,” Keeton said.

He added:

Despite what is happening at a macro-level nationally, we have to take responsibility on the home front and balance our own budgets to the realities that exist.

We don’t have to be defined by a “sky is falling” approach to life – wealth and wellbeing in a marriage or family system is actually rooted in so much more “than the numbers.” It’s in the healthy emotional process of a family system – in how they connect to one another as a team solving a problem and connecting to their faith.

If you’re struggling and need to speak with someone, Focus on the Family offers a free, one-time counseling consultation with a licensed or pastoral counselor. To request a counseling consultation, you can call 1-855-771-HELP (4357) or fill out our Counseling Consultation Request Form.

To check out Focus on the Family resources on the topic of Managing Money, click here.

Related articles and resources:

Counseling Consultation & Referrals

Focus on the Family: Managing Money

Empowering Women to Take Control of Their Finances

Getting a Reluctant Spouse Onboard with Budgeting

Money Talk: The ‘You’ in ‘Unity’ is Silent

Middle-Class Americans Struggling Financially, New ‘Issues 2024’ Brief Reports

Photo from Shutterstock.