Have you filled up your gas tank recently? Or gone to the store to purchase groceries? Or bought practically any other good or service?

If so, you probably looked at your receipt and did a double take, wondering whether that high price could be correct.

If you feel like things are getting more expensive, and therefore your money is losing value, you’re not imagining things.

The annual inflation rate hit another four-decade high in June, the U.S. Bureau of Labor Statistics reported on Wednesday.

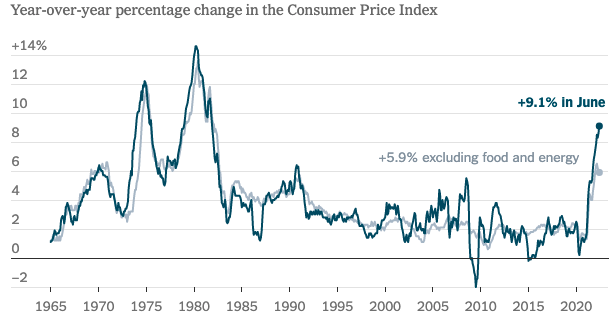

The Consumer Price Index (CPI) increased by 1.3% in the month of June alone, leading the CPI to rise by 9.1% compared to one year ago.

According to the BLS, this increase is “the largest 12-month increase since the period ending November 1981.”

The CPI is the measure of the average change over time in the prices paid by consumers for goods and services.

Photo Credit: The New York Times

BLS noted that the increase was “broad-based,” and showed up in many sectors of the economy, “with the indexes for gasoline, shelter, and food being the largest contributors.”

Compared to one year ago, the price of many consumer goods and services increased compared to one year ago as follows:

- Food is up 10.4%

- Food at home is up 12.2%

- Butter and margarine rose 26.3%

- Fruits and vegetables rose 8.1%

- Cereals and bakery products increased 13.8%

- Energy skyrocketed up 41.6%

- Gasoline shot up 59.9%

- Electricity rose 13.7%

- New vehicles increased 11.4%

- Used cars and trucks increased 7.1%

- Airline fares rose 34.1%

- Shelter rose 5.6%

- Medical care services increased 4.8%

In general, the Federal Reserve, which is America’s central bank, attempts to manipulate the money supply and interest rates in order to keep inflation to a rate of 2% year-over-year.

If you add June’s 1.3% increase to May’s 1.0% rise in the CPI, in just the last two months, inflation hit 2.3% – more than the Fed’s annual target.

Jerome Powell, Chairman of the Federal Reserve – and therefore one of the world’s top economists – recently threw up his hands in regard to inflation. “We now understand better how little we understand about inflation,” Chair Powell said recently.

So, what can families do to combat our nation’s record high inflation rate?

Focus on the Family does not offer financial advice.

However, a record number of families have recently begun purchasing Series I Savings Bonds, a low-risk government bond which is indexed to inflation.

Since November 2021, individuals have purchased $14.9 billion, which is $6 billion more than the previous 20 years combined.

I Bonds are currently paying a 9.62% annual interest rate, which is based on the current inflation rate and reset every six months.

“You are currently receiving an annual interest rate of 9.62%, which is very competitive with the long-term S&P 500 returns,” Elliot Pepper, a financial planner and director of tax at Northbrook Financial in Baltimore, told Bloomberg.

“But unlike the S&P 500, which year-to-date is down 20% or so, you don’t have any sort of downside risk because the I bond is issued by the US government,” he added.

Additionally, married couples should be aware about the strain that financial troubles can add on their relationship.

Geremy Keeton is a Licensed Marriage and Family Therapist and Senior Director of Counseling at Focus on the Family.

He told the Daily Citizen that the high inflation our economy is currently experiencing could cause friction between married couples.

“Tight finances and family stress go hand in hand,” he said.

“Married couples need to talk and plan for the realities they are seeing in their monthly expenses. If one spouse does the family books, and the other does the bulk of the shopping and spending, there needs to be some careful planning so the adjustments in spending choices can be made.

“If a couple does not have the safety, openness and trust in place to have these type of planning conversations, what starts as financial strain can turn into weekly bickering and erode a sense of happiness. Families, and in particular parents, will need better stress management tools and resiliency in this economy.”

If you’re struggling and need to speak with someone, Focus on the Family offers a free, one-time counseling consultation with a licensed or pastoral counselor. To request a counseling consultation, you can call 1-855-771-HELP (4357) or fill out our Counseling Consultation Request Form.

Related articles and resources:

Counseling Consultation & Referrals

Getting a Reluctant Spouse Onboard with Budgeting

Money Talk: The ‘You’ in ‘Unity’ is Silent

Independence Day Barbecue Cost – 17% Increase From Last Year

Inflation Unexpectedly Accelerates to 8.6% in May Leaving Families to Pay the Price

Photo from Shutterstock.