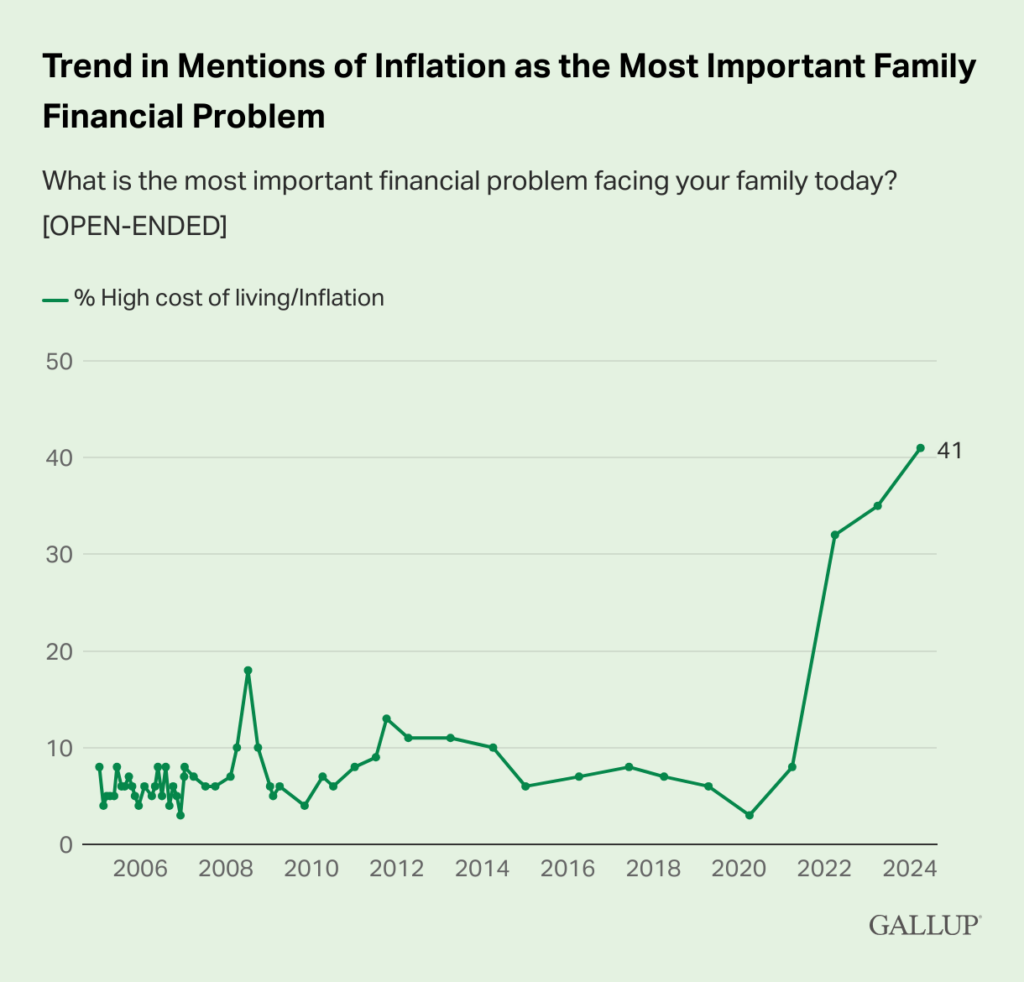

The number of Americans naming inflation or the high cost of living as the most pressing financial problem facing their family reached a record high for the third year in a row.

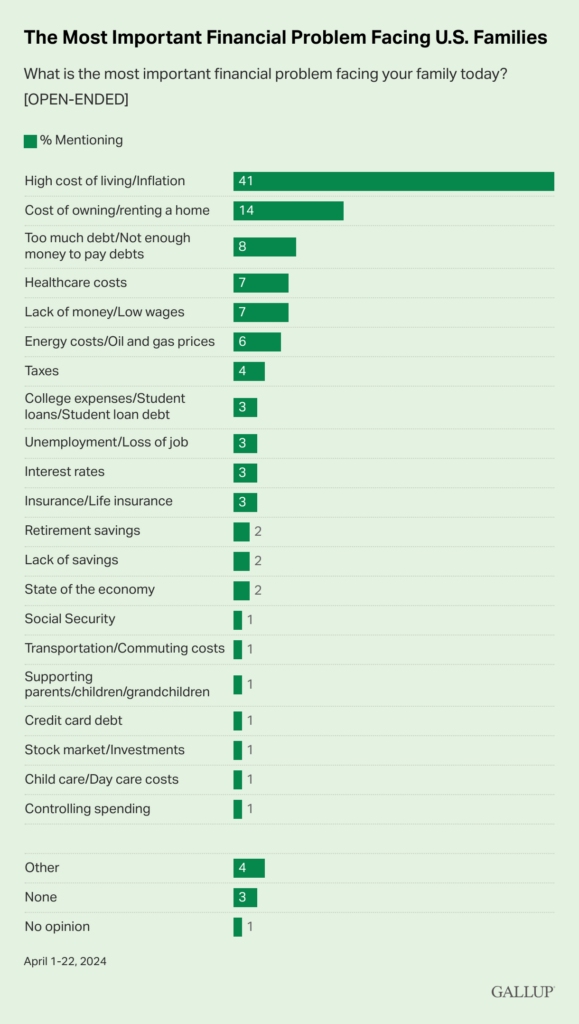

According to a new Gallup survey released on May 2, 2024, 41% of those surveyed named these issues as the most important family financial problem, up from 35% in 2023 and 32% in 2022.

“Before 2022, the highest percentage [of people] mentioning inflation was 18% in 2008,” Gallup noted. “Inflation has been named by less than 10% in most other readings since the question was first asked in 2005.”

Gallup also found that the cost of owning or renting a home ranked second this year at 14%, a new high for the issue.

“Other significant problems Americans identify include having too much debt (8%), healthcare costs (7%), lack of money or low wages (7%), and energy costs or gas prices (6%),” the survey organization reported.

The latest numbers come from Gallup’s annual Economy and Personal Finance poll, which was conducted April 1-22.

High inflation places added financial strain upon marriages and families, especially those already struggling to make ends meet.

When couples encounter financial difficulties, it can quickly weigh on their relationship and harm their marriage if not dealt with in a healthy way.

A 2018 survey from Ramsey Solutions found that money is the number one issue that couples fight about, concluding that “both high levels of debt and a lack of communication are major causes for the stress and anxiety surrounding household finances.”

Ramsey’s survey also revealed that “money fights are the second leading cause of divorce, behind infidelity” (emphasis added).

In a statement to the Daily Citizen, Geremy Keeton, Licensed Marriage and Family Therapist and Senior Director of Counseling at Focus on the Family, told us that families should face tough financial struggles head on.

“In challenging or even dour times, families can show what they are made of – they can still grow, and often for the good, through trials,” Keeton said.

He added:

Despite what is happening at a macro-level nationally, we have to take responsibility on the home front and balance our own budgets to the realities that exist. Individuals need to be realistic and sometimes even creative with how they save or generate supplemental income. Adjustments to such hard times work best with optimism, flexibility and even extra thankfulness for what we do have.

We don’t have to be defined by a “sky is falling” approach to life – wealth and wellbeing in a marriage or family system is actually rooted in so much more “than the numbers.” It’s in the healthy emotional process of a family system – in how they connect to one another as a team solving a problem and connecting to their faith.

If you’re struggling and need to speak with someone, Focus on the Family offers a free, one-time counseling consultation with a licensed or pastoral counselor. To request a counseling consultation, you can call 1-855-771-HELP (4357) or fill out our Counseling Consultation Request Form.

To check out Focus on the Family resources on the topic of Managing Money, click here.

Related articles and resources:

Counseling Consultation & Referrals

Focus on the Family: Managing Money

Empowering Women to Take Control of Their Finances

Getting a Reluctant Spouse Onboard with Budgeting

Money Talk: The ‘You’ in ‘Unity’ is Silent

Middle-Class Americans Struggling Financially, New ‘Issues 2024’ Brief Reports

Inflation Rate Accelerates Again, Increasing Cost-of-Living for Families

Photo from Shutterstock.