Inflation Unexpectedly Accelerates to 8.6% in May Leaving Families to Pay the Price

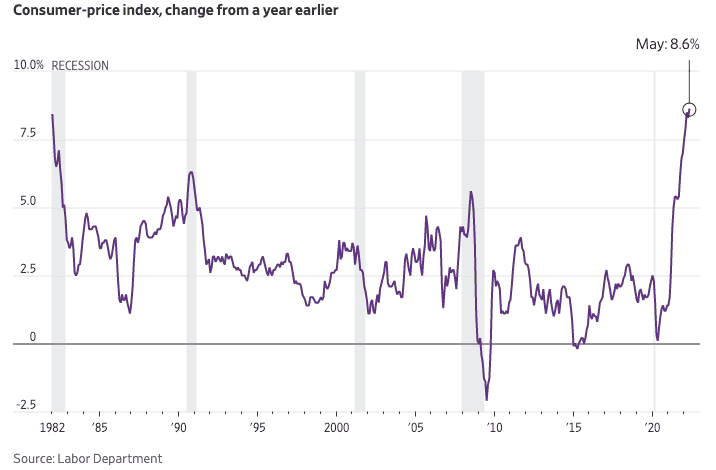

Inflation unexpectedly accelerated once again in May, a U.S. government agency reported on Friday.

The Consumer Price Index (CPI) rose 1.0% in the month of May alone, the U.S. Bureau of Labor Statistics (BLS) said. Compared to one year ago, inflation in May accelerated to 8.6%, a new 40-year high. Inflation has not risen this rapidly since December 1981.

Compared to one year ago, consumers are paying far more for nearly all products and services. The U.S. BLS said inflation was “broad-based, with the indexes for shelter, gasoline, and food being the largest contributors.”

Practically all products and services that are tracked by the CPI increased in May.

The price for the following items skyrocketed compared to one year ago:

- Food rose 10.1%.

- Gasoline shot up 48.7%.

- Electricity increased 12.0%.

- New vehicles rose 12.6%

- Used cars and trucks increased 16.1%.

- Shelter rose 5.5%.

- Transportation services increased 7.9%.

- Medical care services rose 4.0%.

Photo Credit: The Wall Street Journal

The 8.6% annual inflation rate is shocking for another reason, however. Most economists had expected the annual inflation rate to continue to decrease from its high of 8.5% in March. In April, the inflation rate dipped to 8.3%, and most ‘experts’ had thought the rate would continue its decline in May.

Instead, it jumped to new multi-decade highs.

According to Rubeela Farooqui, chief U.S. economist at High Frequency Economics, “For consumers who are going to fill up their car every day or who have to go to the supermarket every day and buy food, it’s a real hardship.”

“[That’s especially true] for those at the lower end of the income scale who have actually run through fiscal support and who are maybe not looking at the cushion from savings that middle-income or high-income households are looking at,” she added.

Anyone who has been to the gas station recently knows what she’s talking about. According to AAA, gas nationwide is now averaging $4.98 per gallon, a record high.

However, it’s even worse for some families, like those who live in California, where gas is currently averaging a nearly unfathomable $6.42 per gallon.

Focus on the Family does not offer financial guidance or advice.

But due to high inflation, a record number of families have turned to Series I Savings Bonds, a low-risk government bond that is currently paying 9.62% interest annually. The bonds’ interest rate is indexed to inflation and adjusted to match the inflation rate every six months.

I Bonds are designed to help protect families’ savings from inflation.

Geremy Keeton, Licensed Marriage and Family Therapist and Senior Director of Counseling at Focus on the Family, told The Daily Citizen about the negative effect that high inflation and economic troubles can have on married couples.

“Tight finances and family stress go hand in hand,” he said.

“Married couples need to talk and plan for the realities they are seeing in their monthly expenses. If one spouse does the family books, and the other does the bulk of the shopping and spending, there needs to be some careful planning so the adjustments in spending choices can be made.

“If a couple does not have the safety, openness and trust in place to have these type of planning conversations, what starts as financial strain can turn into weekly bickering and erode a sense of happiness. Families, and in particular parents, will need better stress management tools and resiliency in this economy.”

If you’re struggling and need to speak with someone, Focus on the Family offers a free, one-time counseling consultation with a licensed or pastoral counselor. To request a counseling consultation, you can call 1-855-771-HELP (4357) or fill out our Counseling Consultation Request Form.

Related articles and resources:

Counseling Consultation & Referrals

Inflation Rate Hits Four-Decade High of 8.5%, Harming Poor and Middle-Class Families the Most

Inflation Hits New 40-Year High, Harming Families Struggling to Make Ends Meet

Inflation Increases to 7.5% in January, a 40-Year High. Here’s How Families Can Respond.

Inflation Spikes 5.4% in June, Largest Increase Since 2008

Inflation Has Arrived. Here’s What it Means for Your Family.

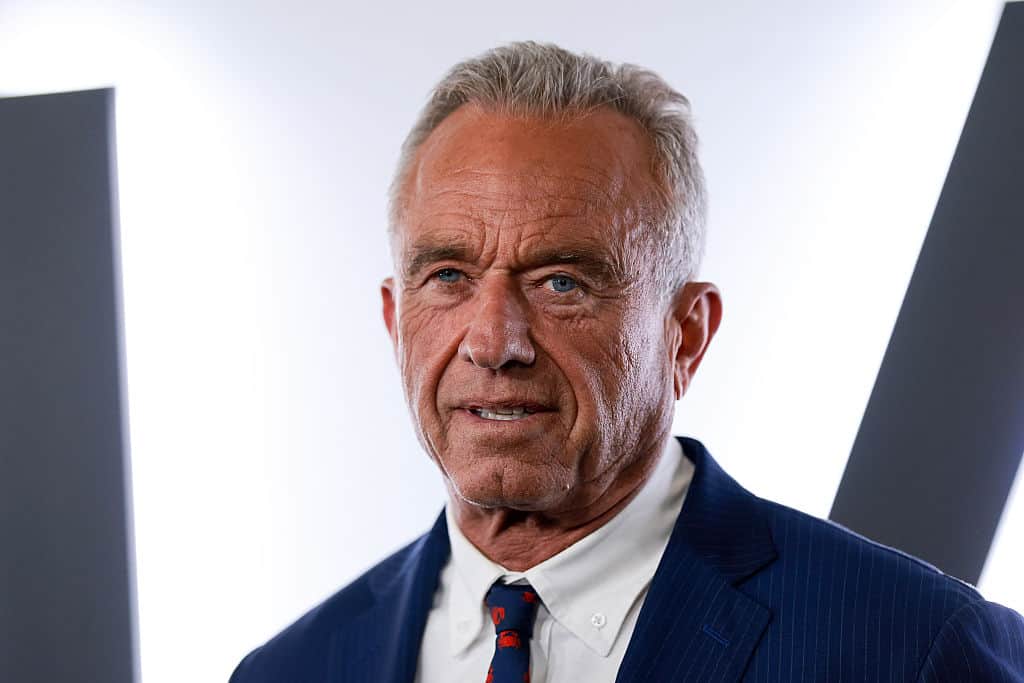

Photo from Shutterstock.

ABOUT THE AUTHOR

Zachary Mettler is a writer/analyst for the Daily Citizen at Focus on the Family. In his role, he writes about current political issues, U.S. history, political philosophy, and culture. Mettler earned his Bachelor’s degree from William Jessup University and is an alumnus of the Young Leaders Program at The Heritage Foundation. In addition to the Daily Citizen, his written pieces have appeared in the Daily Wire, the Washington Times, the Washington Examiner, Newsweek, Townhall, the Daily Signal, the Christian Post, Charisma News and other outlets.

Related Posts

Vermont Win for Children, Foster Families and Religious Freedom

February 24, 2026