Inflation has hit another four-decade high of 8.5 percent in March, according to newly released numbers from the U.S. Bureau of Labor and Statistics (BLS).

“The all items index continued to accelerate, rising 8.5 percent for the 12 months ending March, the largest 12-month increase since the period ending December 1981,” BLS reported on Tuesday.

Inflation increased by a stunning 1.2 percent in the month of March alone.

If the 1.2 percent March inflation increase was annualized, the year-over-year inflation number would be a whopping 14.4 percent.

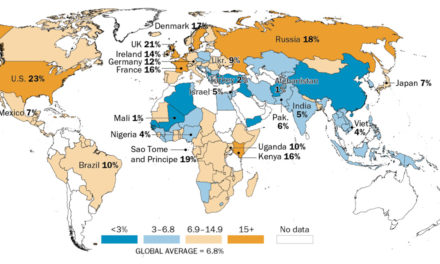

Photo Credit: The Wall Street Journal

Consumers are paying much more for everyday items than they were just one year ago, including 8.8 percent more for food, 32 percent more for energy, a shocking 48 percent more for gasoline, 12.5 percent more for new vehicles, 25.3 percent more for used cars and trucks, 6.8 percent more for apparel, and 5 percent more for shelter.

In the month of March alone, grocery prices rose 1.5 percent; the price of meats, poultry, fish and eggs increased 1 percent; cereals and bakery products rose 1.5 percent; the price of gasoline shot up 18.3 percent; airline fares rose 10.7 percent; and medical care increased 0.5 percent.

Additionally, there is some concern that the BLS underreports the real amount of inflation experienced by consumers.

Shelter is the largest component of the Consumer Price Index (CPI), accounting for around one third of the index. The BLS reports that the cost of shelter increased 5 percent over the past year.

But according to the S&P CoreLogic Case-Shiller Index, one of the leading measures of real estate prices, home prices nationally have actually risen 19.2 percent year over year as of January 2022.

And according to a recent report from Realtor.com, the national median rent rose a stunning 17 percent year-over-year as of February 2022.

If the double digit increase in the cost of shelter was included in the CPI, rather than the BLS’ reported 5 percent increase, the CPI would be several percentage points higher, easily in double digit territory.

The next report for the CPI, covering the month of April 2022, will be released on May 11, 2022.

The suffering and stress caused by elevated levels of inflation does the most harm to poor and middle-class families.

“There’s an element of sticker shock when people go to fill up their tank or go to the grocery store,” Richard F. Moody, chief economist at Regions Financial Corp., told The Wall Street Journal. “Lower- and middle-income households are already having to make choices about what to buy because they’re having to pay so much more for food and energy.”

When considering economic news like the rising CPI, it’s also important to note that studies have found that financial struggles are one of the leading causes of divorce in America today.

“Money fights are the second leading cause of divorce, behind infidelity,” a 2017 study by Ramsey Solutions found. “Results show that both high levels of debt and a lack of communication are major causes for the stress and anxiety surrounding household finances.”

Geremy Keeton, Licensed Marriage and Family Therapist and Senior Director of Counseling at Focus on the Family, told us about the harm that financial struggles can have on marriages.

“Tight finances and family stress go hand in hand,” Keeton said.

“Married couples need to talk and plan for the realities they are seeing in their monthly expenses. If one spouse does the family books, and the other does the bulk of the shopping and spending, there needs to be some careful planning so the adjustments in spending choices can be made.

“The bottom line is, it causes stress. Families, and in particular parents, will need better stress management tools and resiliency in this economy,” Keeton added.

If you’re struggling and need to speak with someone, Focus on the Family offers a free, one-time counseling consultation with a licensed or pastoral counselor. To request a counseling consultation, you can call 1-855-771-HELP (4357) or fill out our Counseling Consultation Request Form.

Related articles and resources:

Counseling Consultation & Referrals

Inflation Hits New 40-Year High, Harming Families Struggling to Make Ends Meet

Inflation Increases to 7.5% in January, a 40-Year High. Here’s How Families Can Respond.

How Inflation Silently Steals Your Money and Harms Families

Photo from Shutterstock.