Borrowed Future, a new documentary from Ramsey Solutions, is shining a spotlight on the colossal and growing student loan crisis. The film highlights the tragic stories of those drowning in student loan debt and cautions would be borrowers from instinctively taking on huge sums of student loans.

“The student loan problem has reached epidemic proportions,” said Dave Ramsey, host of “The Ramsey Show,” CEO of Ramsey Solutions, and executive producer of Borrowed Future.

Spread across 43.2 million Americans, the average borrower now owes $39,351 in student loan debt.

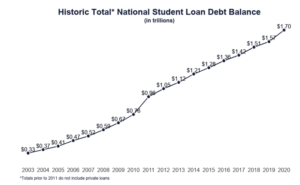

The collective amount of student loan debt has grown enormously in the past two decades. In 2003, the total amount was just $330 billion. Now, Americans collectively owe over $1.73 trillion in student loans, marking a fivefold increase in less than two decades.

Photo Credit: Education Data Initiative

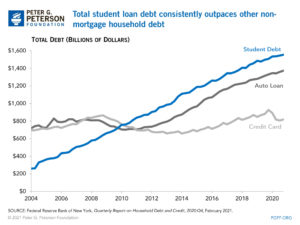

Student loan debt is growing faster than any other kind of debt in the United States, including auto loans and credit card debt. It is now the second-largest source of debt in the U.S., only behind mortgage debt.

Photo Credit: Peter G. Peterson Foundation

It’s ironic to me that the dumbest decisions we make as a society are related to education, of all things,” Ramsey said in a statement regarding the new film.

“Student loans are not the only way to get a degree. Young people need to know all their options instead of settling for student loans because it’s ‘normal.’ Normal is broke.”

Borrowed Future premiered on October 14, 2021 and is available to rent or buy on Amazon Prime Video, Apple TV and Google Play.

The film is directed by David DiCicco and features experts like Seth Godin, Dave Ramsey, Seth Frotman, Kristina Ellis, Dr. John Delony and Anthony ONeal, as well as the CEO of the mikeroweWORKS Foundation, Mike Rowe.

Rowe observes in the film that “the cost of college has grown faster than the cost of energy, the cost of real estate, the cost of healthcare, all of it.”

“Somehow, we got it in our heads that its priceless, and we’ve told an entire generation of kids if they don’t borrow whatever it takes [they’ll be] hopelessly disadvantaged.”

Borrowed Future shares the story of Josiah, who lives in Van Wert, Ohio with his wife. He’s a high school social studies teacher who took out $110,000 in student loans to pay for his college degree.

“My game plan was the game plan that everyone else had,” Josiah says. “I’m going to apply to get student loans. I always thought everything was going to be fine, everything will sort itself out.”

“Everyone in the pictures, they’re so happy holding their diplomas walking across the stage. By the time the graduation ceremony was, I had realized it’s not this happy go lucky time.”

Josiah explains that even though he had taken out $110,000 in student loans, “[because] interest had been gathering the entire time, it had ballooned to $125,000 after four and a half years of college.”

“It was something that I was not prepared for. It was an avalanche coming down on me.”

The couple has struggled to make ends meet, even with both of them working. Twice a week, Josiah drives to a different city to donate plasma to earn extra money.

Even with the extra cash, Josiah is on a 30-year repayment plan for his student loans.

“I’m paying all these bills, and I have nothing,” he laments.

Courtney, Josiah’s wife, shares about the emotional impact the debt has had on the couple.

She explains how after they were denied a loan for a mortgage, “It definitely put us in perspective, like we would never get a house. We wouldn’t be able to have kids. We’re not going to be able to live.”

“The first hardest thing for me was right after we got married, we could not go on a honeymoon. And I know that sounds cliché, but you don’t realize, you’ll never have that moment, that time again … We lost out on that time. That was hard.”

Josiah also says, “It stopped us from being able to get a house … It stopped us for a long time from having kids. I’m not being the man I’m supposed to be.”

To help educate potential college students about the ramifications of student loan debt, Ramsey Solutions is offering every teacher in the United States free access to the documentary to show their students.

Student loan payments have been paused for nearly two years during the COVID-19 pandemic. However, payments are set to resume starting January 31, 2022.

In a future article, The Daily Citizen will feature an interview with an expert who will share advice for those currently paying off student loan debt. Stay tuned.

To learn more about or view Borrowed Future, visit www.borrowedfuture.com.

Related articles:

Strategies for Covering the Cost of Higher Education

Photo from YouTube.