Deep Dive: What the Media Gets Right and Wrong About the Big, Beautiful Bill — and Why Families Should Care.

American families deserve to know how their federal tax dollars are spent. But no busy parent I know has time to parse a 330-page budget bill.

Congress passed one such mega bill on July Fourth. The “One, Big Beautiful Bill” weighs in on a myriad of issues that affect families’ lives — and it’s nearly impossible for the average Joe to parse.

The press is supposed to bridge the gap, breaking complex legislation down for parents to read on the go.

Unfortunately, the legacy media’s coverage of the Big, Beautiful Bill abandoned nuance and context in favor of a few, tried and true talking points. The vast discrepancies in coverage between partisan outlets left parents confused about policies and regulations dictating, in part:

- How much of their paycheck they can keep.

- Whether they can access government-subsidized healthcare.

- Whether the government uses their tax dollars to fund abortion.

The Daily Citizen dove deep into the weeds to compare the media’s most popular narratives with what the Big, Beautiful Bill actually says.

Here’s what parents need to know.

False.

Legacy media outlets frequently characterize the Big, Beautiful Bill as a tax cut for the rich at the expense of the poor.

“For the most part, the more you earn, the more likely you are to benefit from the bill,” The New York Times wrote on July 3, calling the tax cuts, “More regressive than any major law in decades.”

This description allows readers to erroneously infer that the bill rewards the rich simply because they are rich. This is false.

The Big, Beautiful Bill directly benefits Americans by cutting taxes, which allows citizens to keep more of their paychecks. Families in the lowest three income brackets won’t benefit from these cuts because they don’t pay any federal income tax.

Conversely, the highest earners, who pay the most federal taxes every year, will receive the most money back.

True.

The Big, Beautiful Bill increases the federal deficit by significantly decreasing its tax revenue. Excluding the impact of the tax cuts, however, the bill cuts federal spending by some $500 billion.

Misleading.

The Times and Wall Street Journal are among the myriad outlets predicting the Big, Beautiful Bill cause some 8 million people to lose Medicaid coverage.

Crucially, this bill does not kick anyone off Medicaid; it increases the eligibility requirements for a very specific group of people seeking benefits. These people are:

- Under 65-years-old.

- Not pregnant.

- Not entitled to or enrolled in Medicare Part A or B, which means they aren’t receiving retirement or disability benefits.

- Making an income 33% above the federal poverty line.

This group of able-bodied adults can continue to receive Medicaid coverage under the Big, Beautiful Bill, but they must prove their eligibility more frequently, meet basic work requirements and pay modest out-of-pocket fees, like copays, for their medical treatments.

Importantly, The Journal predicts this group of adults adults will lose Medicaid coverage, not because they can’t access it, but because, “They won’t bother to comply with the new rules or because they aren’t able to keep up with the paperwork and other bureaucratic hurdles states will erect for proving eligibility.”

“Not bothering” to keep up with Medicaid eligibility requirements is far different than being kicked off Medicaid.

Misleading.

“The [Big, Beautiful Bill] slashes over $1 trillion in healthcare spending over the next decade, mostly from Medicaid,” the Journal wrote on July 6.

The verb “slash,” here, implies the bill dramatically cuts Medicaid spending itself. This is inaccurate. Medicaid spending will decrease over the next decade as a natural consequence of the Big, Beautiful Bill’s provisions, including:

- Increased eligibility requirements for able-bodied adults, which could cause people who don’t need Medicaid to withdraw from the program.

- Rules making it harder for beneficiaries to illegally enroll in multiple state Medicaid plans.

- Rules requiring states to check Medicaid records against death records more frequently to keep from paying for services rendered to dead people.

- Reduced federal responsibility for erroneous state Medicaid payments, like payments made to people who aren’t eligible.

The Journal itself predicts 93% of these forecasted Medicaid cost reductions will occur in states that have expanded the program to care for able-bodied adults. But this presupposes the Big, Beautiful Bills’ new eligibility criteria will cause able-bodied adults to leave Medicaid in the first place.

It bears repeating: nothing in the Big, Beautiful Bill prevents this group from continuing to receive Medicaid coverage.

False.

“The [Big, Beautiful Bill] imposes a strict new work requirement on many adult beneficiaries, requiring them to prove they have worked at least 80 hours a month before they can enroll,” the Times assesses.

In reality, the bill’s “Community Engagement” standards require able-bodied adults to meet just one of the following benchmarks in a month:

- Work at least 80 hours.

- Complete at least 80 hours of community service.

- Be enrolled in an educational program at least half-time.

- Complete a combination of work, community service and education for at least 80 hours.

- Make at least as much money in a month as someone would make working 80 hours a month at a job paying federal minimum wage.

- Make at least as much money in six months as someone would make working for six months at a job paying federal minimum wage.

The bill also includes several exceptions exempting people from work requirements, including people:

- Under 26-years old.

- Enrolled in or eligible for Medicare.

- Caring for a disabled person or children under 13 years old.

- With disabilities or special needs.

- Requiring pregnancy and postpartum care.

- Receiving treatment for drug and alcohol addictions.

False.

Another evident proponent of the verb “slash,” the Times writes, “To pay for [tax cuts and immigration funding in the Big, Beautiful Bill], [proponents] are looking for other programs to slash — most contentiously, those that help low-income Americans, particularly Medicaid and food stamps.”

We’ve already addressed why “slash” is a misleading verb to describe changes to Medicaid. The Big, Beautiful Bill doesn’t slash SNAP (food stamps) either — it just doesn’t expand it.

SNAP funding for American families is determined through the Thrifty Food Plan, which measures the commercial cost of a nutritious, budget-conscious diet for a family of four.

The bill specifies what percentage of this budget families of different sizes should receive, with larger families receiving more assistance. It caps SNAP funding at double the allotment for a family of four.

The Big, Beautiful Bill also prevents SNAP spending from increasing through 2032.

False.

In this article, the Times quoted Georgetown law professor David Super, who predicts modestly adjusted SNAP work requirements will cause states to drop people from the program.

“A lot of states are going to say: ‘We don’t have the capacity to take reports from people monthly about their working 20 hours. We’re just basically not going to make ourselves available for that,’” Super told the Times. “Those folks will all drop from the program.”

The Big, Beautiful Bill doesn’t change SNAP work requirements, only who must comply with them. For instance, people between 55 and 65 years old now must now complete the condition. Previously, people under 55 were exempt.

Super suggests the extra paperwork will cause states to kick people off SNAP — but SNAP is a federally-funded program. States cannot legally drop eligible citizens or delay processing their applications, per this federal regulation.

This is part of the reason why the bill’s new SNAP rules won’t go into effect until 2028, at the earliest. States need time to prepare the resources necessary to follow federal law.

We live in a world of endless information. American families increasingly rely on the press and other intermediaries to tell them not just what is true, but what is important.

The legacy media’s coverage of the Big, Beautiful Bill demonstrates how few of these powerful interpreters provide contextualized, nuanced analysis of issues that affect families’ everyday lives.

Instead, they leave the people that rely on them with incomplete or erroneous information.

That’s unconscionable — and it needs to be called out.

In the meantime, parents should get into the habit of “triangulating.” Get your news from at least three different outlets, including at least one you disagree with. By comparing competing coverage of the same issues, families can better determine what is fact and what is fiction.

Additional Articles and Resources

Federal Judge Rules Trump Administration Must Keep Funding Planned Parenthood

House Passes ‘One Big Beautiful Bill Act,’ Finally Defunding Planned Parenthood

Senate Passes ‘Big, Beautiful Bill’ to Defund Planned Parenthood, Lower Taxes

Reality Check — Media Skews Christians’ Grasp of Truth

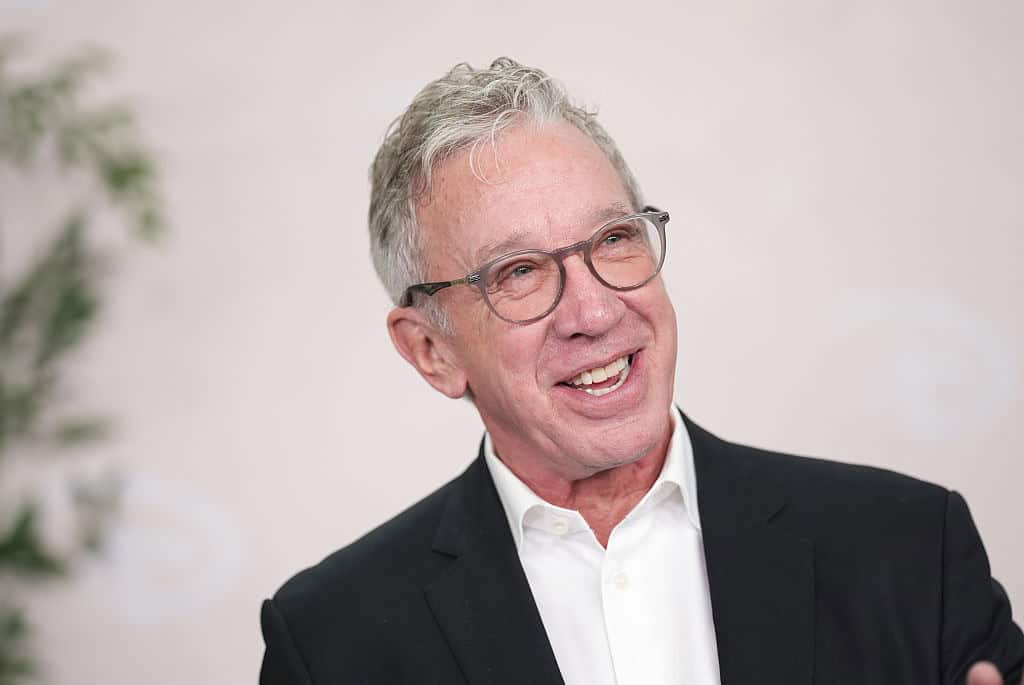

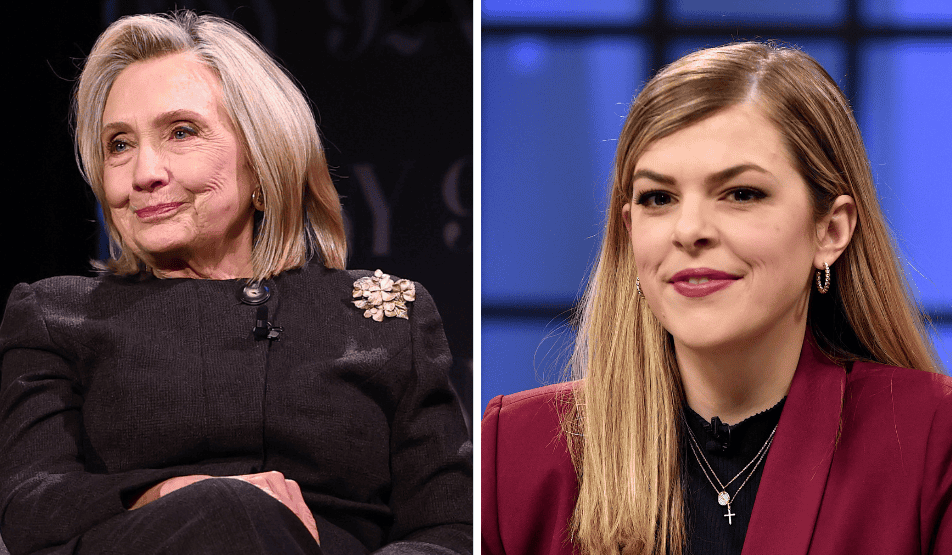

ABOUT THE AUTHOR

Emily Washburn is a staff reporter for the Daily Citizen at Focus on the Family and regularly writes stories about politics and noteworthy people. She previously served as a staff reporter for Forbes Magazine, editorial assistant, and contributor for Discourse Magazine and Editor-in-Chief of the newspaper at Westmont College, where she studied communications and political science. Emily has never visited a beach she hasn’t swam at, and is happiest reading a book somewhere tropical.