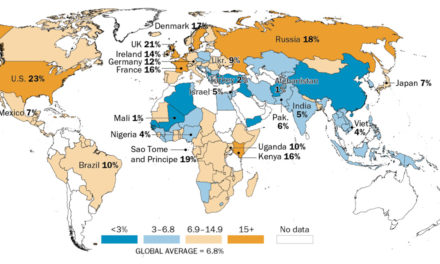

Inflation remained elevated in September, rising 8.2% over the past year, the U.S. Bureau of Labor Statistics (BLS) reported on Thursday. In the month of September alone, prices rose 0.4%.

“The all items index increased 8.2 percent for the 12 months ending September, a slightly smaller figure than the 8.3-percent increase for the period ending August,” BLS reported.

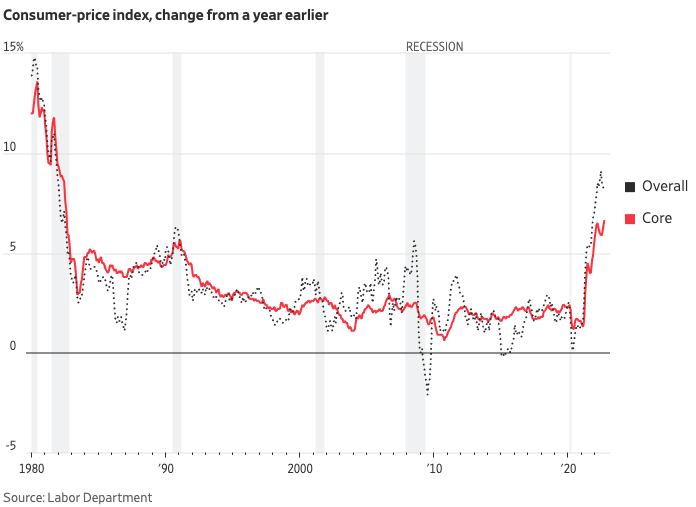

The so called “core measure” of inflation, or the price of goods and services excluding the more volatile indexes of food and energy, increased 6.6% over the last year. This marked the biggest increase in core inflation in 40 years.

Photo Credit: The Wall Street Journal

Over the last year, the prices of goods and services that Americans purchase have risen as follows:

- Food increased 11.2%.

- Cereals and bakery products rose 16.2%.

- Energy has risen 19.8%.

- Gasoline shot up 18.2%.

- Electricity increased 15.5%.

- New vehicles have risen 9.4%.

- Shelter has increased 6.6%.

As a result of skyrocketing inflation, the Social Security Administration announced on Thursday that Social Security checks will be increased by 8.7% in 2023, “the largest cost-of-living adjustment to benefits in four decades.”

“The extra funds will provide relief for many of the roughly 70 million Social Security recipients … The average monthly Social Security check for retired workers will rise to $1,814 in January, up from $1,669 this year,” The WSJ reports.

EJ Antoni, research fellow for Regional Economics in the Center for Data Analysis at The Heritage Foundation, told the Daily Citizen that “the current inflationary scourge is the direct result of the Federal Reserve printing trillions of dollars to finance the profligate spending of Congress and the White House.”

“American families are being crushed by these ever-increasing prices – the average worker has lost the equivalent of over $3,000 annual salary because prices have risen so much faster than wages. Higher interest rates are now adding insult to injury, costing the average American another $1,200 a year in higher interest payments,” Antoni added.

Families have taken multiple financial hits this year.

On top of inflation, which remains elevated and ongoing, the United States’ economy officially entered a recession earlier this year. According to the U.S. Bureau of Economic Analysis (BEA), the U.S. economy shrunk for two consecutive quarters this year in the first (Q1) and second (Q2) quarters.

The BEA found that the economy shrank by 1.6% in Q1 and another 0.6% in Q2.

“Millions of American families are hurting right now because of impolitic policies in Washington,” Antoni told us. “Monthly savings have plummeted, and housing is increasingly unaffordable for the middle class.”

Rising costs place added stress on marriages. According to one 2018 study, financial troubles are the second leading cause of divorce, behind infidelity.

“Both high levels of debt and a lack of communication are major causes for the stress and anxiety surrounding household finances,” the study found.

Craig Constantinos, MA, LPCC, Counselor in the Counseling Services Department at Focus on the Family, spoke to the Daily Citizen about our economic climate.

“Stress and anxiety about the economy can often lead to frustration and conflict in marriages, as finances is one of the areas where different perspectives are most obvious,” Constantinos said.

“Having a grace-filled conversation about budgets and spiritual and financial goals can lead to deeper understanding in a marriage, which can turn the challenge of financial uncertainty into an opportunity to build one’s relationship with God and their spouse.”

If you’re struggling and need to speak with someone, Focus on the Family offers a free, one-time counseling consultation with a licensed or pastoral counselor. To request a counseling consultation, you can call 1-855-771-HELP (4357) or fill out our Counseling Consultation Request Form.

Related articles and resources:

Counseling Consultation & Referrals

U.S. Officially Enters Recession as Families Struggle to Make Ends Meet

Families Are Being Hit Hard by Tough Economic Headwinds, Economist Says

Inflation Hits Another Four Decade High of 9.1%, Hitting Struggling Families the Hardest

Getting a Reluctant Spouse Onboard with Budgeting

Money Talk: The ‘You’ in ‘Unity’ is Silent

Photo from Shutterstock.